The Dispatch: Week 44

GM drops CarPlay for full-stack control, Nexperia freeze jolts silicon supply, and Mahindra taps Samsung for digital keys.

SDV Insider — October 31, 2025

Happy Halloween 🎃! While costumes and candy take center stage tonight for many, the real scares are hitting factory floors and silicon supply chains. GM and other global automakers are cutting jobs as EV demand dips under tariff drag and legacy structures strain to bankroll software-defined vehicle investments. At the same time, chip shortages are reemerging from the shadows, threatening production just as automakers consolidate compute into centralized SDV platforms. Together, shrinking teams and fragile supply chains are testing which OEMs can evolve fastest — before the software shift devours the old model whole. Let’s get into it.

🚀 Top Story

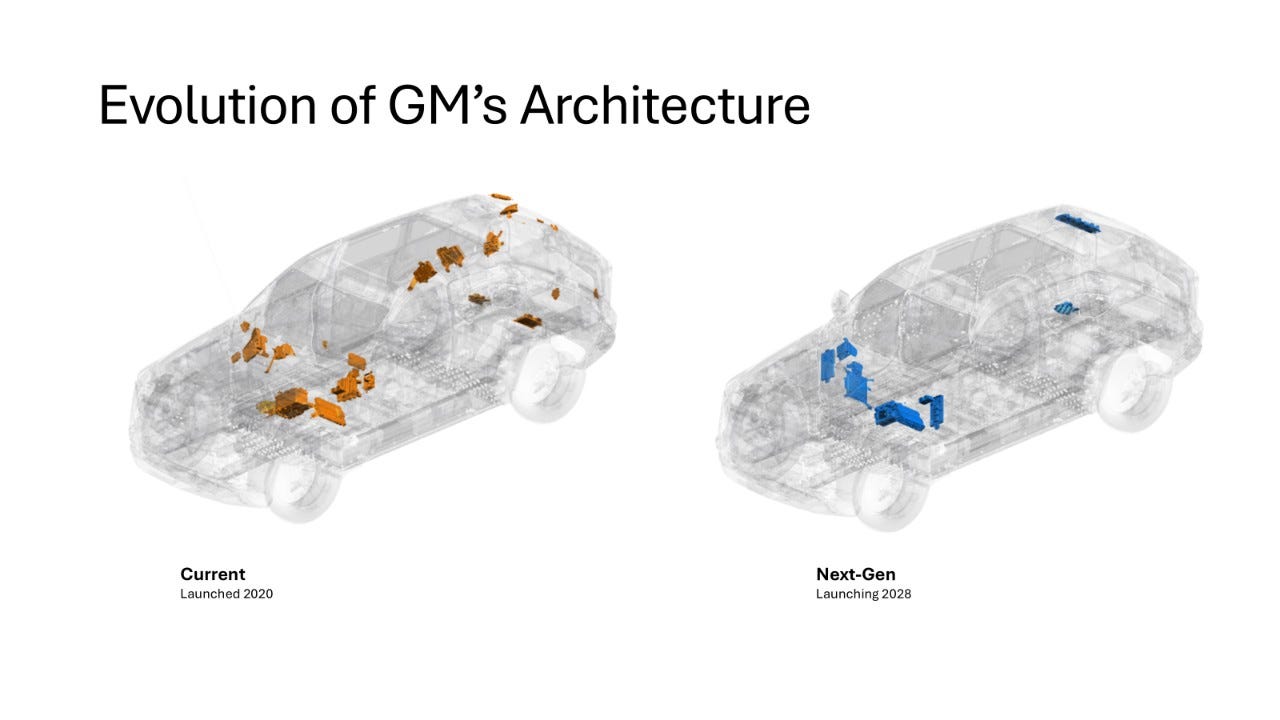

GM doubles down on in-house software: centralized compute and the end of CarPlay

GM confirmed it will phase out Apple CarPlay and Android Auto across all future models—EV and ICE alike—as it transitions to a unified, centralized computing architecture built around its in-house, Android-based SDV platform. GM will launch the new platform starting with the Cadillac Escalade IQ in 2028 and claims “already, more than 4.5 million GM vehicles can receive over-the-air vehicle system updates, a number growing by about 2 million per year”. The same move underpins GM’s new NVIDIA Thor–powered compute core, which consolidates dozens of ECUs and connects every domain—from propulsion to infotainment—through a single software backbone. By owning the full stack, GM aims to unify driver interfaces, data, and update loops under one ecosystem.

Our take: This is the clearest sign yet that OEMs see value in reclaiming digital real estate from Big Tech. By dropping CarPlay, GM hopes to gain end-to-end visibility and OTA agility, but risks alienating users accustomed to their smartphone-native and seamless experience. The wager? That its centralized SDV platform can deliver richer, safer, and more monetizable in-vehicle software—on GM’s own terms.

⚙️ Industry Pulse

Chips & Supply Chain Crunch

A Chinese export freeze on Nexperia chips has rippled through global auto production, forcing Honda to cut output and pushing VW and Mercedes to ration remaining supply. The dispute—sparked by the Dutch government seizing Nexperia under strategic control powers—has throttled shipments of the automotive-grade MCUs that underpin zonal controllers and SDV compute nodes. This isn’t about volume, but specific silicon that keeps vehicle networks alive. The takeaway: software-defined progress still runs on political hardware, making silicon sovereignty as critical as software reuse.

LG joins the “SDVerse”

LG listed its AlphaWare suite on the SDVerse B2B platform co-founded by GM, Magna, and Wipro. The portfolio spans AR/MR navigation, OS support, and lifecycle ops—showing how suppliers are packaging software modules for direct OEM sourcing. It’s a step toward marketplace-style procurement that shrinks integration loops and boosts transparency.

Edge Acceleration

Japan’s Morgenrot has joined the AECC (Automotive Edge Computing Consortium) to advance distributed HPC for connected vehicles. Expect closer ties between automakers, telcos, and cloud providers as edge compute becomes the nervous system for real-time analytics and OTA scale.

💼 Company Moves & Partnerships

Samsung × Mahindra: digital car keys for Electric Origin SUVs

Samsung India announced a partnership with Mahindra Automotive to introduce digital key capabilities—built into the Samsung Wallet—to replace physical keys with shareable and secure mobile access for Mahindra’s Electric Origin SUV models. Expect digital identity and access management to become baseline SDV features across new platforms.

📊 Market & Reports

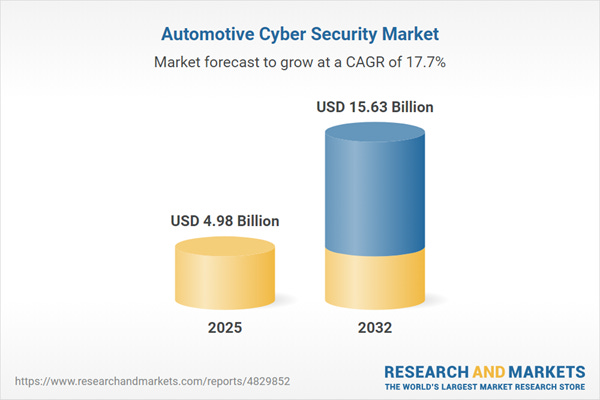

Automotive Cybersecurity Market 2025

A recent report by Research & Markets states global automotive cybersecurity revenues climbed $750 million YoY to $4.98 billion, projected to hit $15.6 billion by 2032 (17.7% CAGR). Growth is fueled by OEM investment in in-vehicle intrusion detection, secure boot, and OTA compliance, alongside zero-trust frameworks and modular security architectures. The report ties this momentum to new regulatory requirements linking market access to cyber resilience—a shift from ECU hardening to full-stack data governance.

Connectivity & Infrastructure: SDV delays create a telco moment

A new QNX report finds UK SDV progress slowed by regulatory overload and recall pressures, creating space for telcos to supply secure edge and data infrastructure. When OEM pipelines stall, network operators step in to keep the software moving.

📅 Events

SAE Software-Defined Vehicle Summit — November 12th, 2025

SAE International will host its annual SDV Summit (live virtual) on November 12th that brings automakers, suppliers, and cloud partners together to discuss standards, toolchains, and lifecycle security. Expect announcements on architecture unification and SDV governance.

👋 That’s a Wrap

Centralized compute is in, chip supply is tight, and edge players are moving up the stack. SDV is no longer a concept — it’s an architecture arms race. Got tips or wins? Reply here or email editor@sdvinsider.com. See you next week. 🚗💨

— The SDV Insider Crew 🚗