From Highways to Hyper Connectivity: Inside the Global Showdown for Commercial Vehicle Supremacy

Electrification, AI, and emerging challengers are reshaping the $1 trillion global commercial vehicle market.

Introduction: A Shifting Global Landscape

🚛 The commercial vehicle (CV) industry is the backbone of the global economy, moving goods and people across continents. In 2023, the global CV market was valued at roughly $1.07 trillion, and it’s on track to nearly double to $2.08 trillion by 2032 (about 7.3% CAGR). This broad market spans light commercial vehicles (LCVs) like vans and pickups, medium and heavy commercial vehicles (M&HCV) like trucks, and buses. North America and Asia-Pacific dominate in volume – North America alone accounted for ~59% of global CV market value in 2023, with robust demand for heavy-duty trucks and vans. Asia-Pacific isn’t far behind, representing about 35% of global CV sales, fueled by China’s massive production (over 4 million CVs in 2023) and rapid urbanization. Europe and Latin America constitute the rest, with Europe holding ~15% share of new CV sales.

The industry has rebounded strongly post-pandemic – global CV sales reached ~28.5 million units in 2024, up 7.9% year-on-year, including 18.7 million LCVs (55% of the total) and 3.3 million medium/heavy vehicles. This growth comes amid transformative trends. Electrification, digital connectivity, and new competition are reshaping the CV landscape. Stricter emissions rules and climate goals are pressuring OEMs to accelerate battery electric vehicle (BEV) and fuel cell electric vehicle (FCEV) programs. Fleet customers are demanding smarter, safer trucks – from telematics and over-the-air (OTA) software updates to advanced driver aids and vehicle-to-everything (V2X) communication. At the same time, emerging players (often from China and tech sectors) are challenging incumbents with innovative models and business approaches.

The following sections present a market map of major OEMs and brands, and dive into key industry trends with insights for stakeholders, let’s go.

Mapping the Global Commercial Vehicle Market

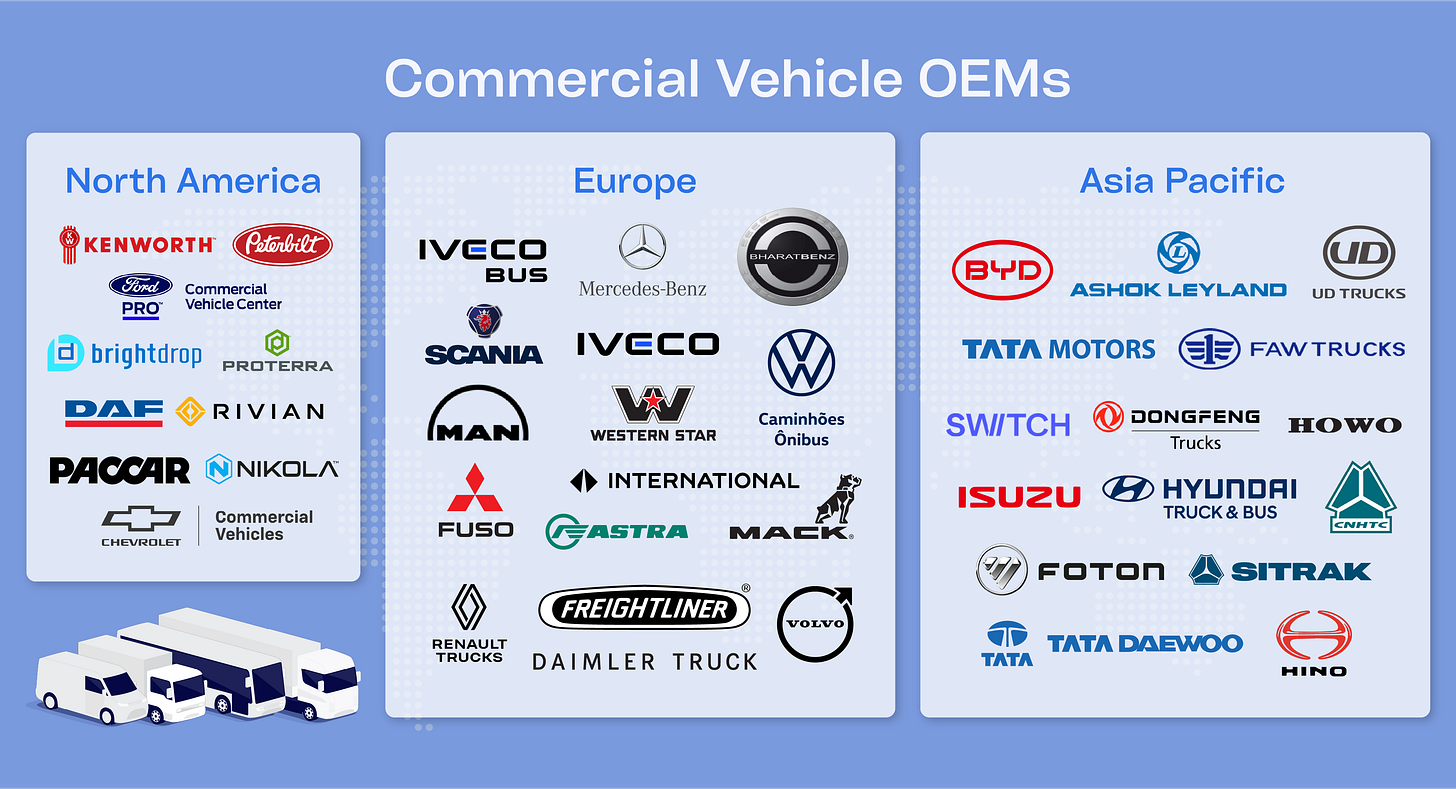

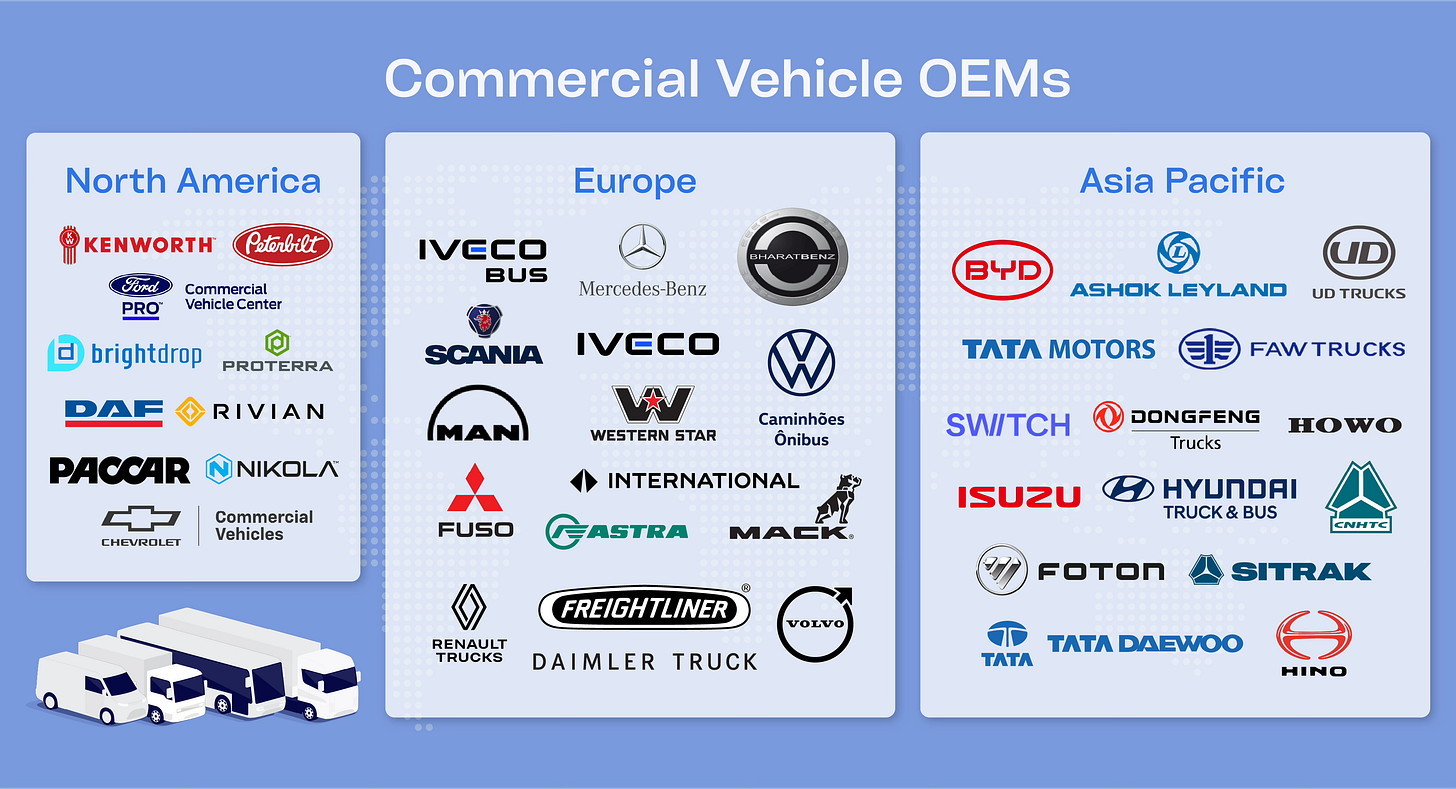

The CV market is highly consolidated among a dozen or so corporate groups, each with a portfolio of brands across regions and segments. These span well-known Western truck giants and Asian manufacturers, covering LCVs, heavy trucks, and buses.

A few global companies own many familiar brands. For example, Daimler Truck – the world’s largest CV manufacturer – produces Freightliner, Western Star, Mercedes-Benz, Fuso, and BharatBenz. Traton (Volkswagen’s truck division) similarly houses Scania, MAN, and now Navistar’s International brand in the U.S. Traditional Western OEMs have built these portfolios via acquisitions and alliances over decades, giving them a presence in all major markets.

Meanwhile, Asia’s giants like FAW, Dongfeng, and Sinotruk command huge domestic volumes in China, often outselling Western firms in unit terms, though their footprint beyond emerging markets is limited. India’s Tata Motors and Ashok Leyland lead their home market and are now pushing into new energy vehicles and exports. BYD, originally a battery maker, has rapidly become a global force in electric buses and trucks, leveraging China’s EV boom.

It’s worth noting how concentrated some regional markets are despite the global diversity of brands:

🇺🇸 In North America, four corporate groups account for 99.9% of Class 8 (heavy-duty) truck sales – Daimler (Freightliner/Western Star), PACCAR (Kenworth/Peterbilt), Volvo (Volvo/Mack), and Traton (Navistar). Freightliner alone held about 36.5% of the U.S. Class 8 market in 2023.

🇪🇺 In Europe, Volvo Trucks just claimed the top spot with 17.9% of the 2024 heavy truck market, closely followed by Daimler’s Mercedes-Benz and Traton’s Scania/MAN.

🇨🇳 In China, the top five manufacturers made ~43% of global CV sales in 2024, although spread across numerous state-linked brands.

In short, scale matters in this industry—yet new entrants are appearing and carving out niches, especially in the realms of electrification and technology.

Electrification: From Diesel Workhorses to Electric & Hydrogen

A fast shift toward zero-emission commercial vehicles is underway. Regulators around the world are setting aggressive targets to decarbonize trucks and buses, pushing OEMs into battery-electric and hydrogen fuel cell technologies.

🚚 Global sales of electric trucks surged 35% in 2023 (to about 54,000 units), even surpassing electric bus sales for the first time. China led the way, accounting for ~70% of electric truck sales in 2023. Europe’s electric truck market tripled to 10,000+ units, and North America’s tripled as well (to ~1,200 units). On the bus side, 50,000 electric buses were sold globally in 2023—about 3% of all new bus sales.

📜 Regulatory drivers:

The EU has approved CO₂ standards requiring a 90% reduction in truck emissions by 2040

The U.S. EPA targets up to 60% ZEV truck sales by 2032

California’s Advanced Clean Trucks rule sets phased mandates this decade

Cities worldwide—from London to Los Angeles—are announcing zero-emission delivery zones

China continues strong subsidies and mandates under its NEV strategy

🔋 OEM responses:

Battery Electric Vehicles (BEVs): Nearly every major OEM has launched or announced electric models. Volvo, Daimler, Scania, MAN, and DAF all offer 200–300 km range heavy-duty trucks. In North America, the Freightliner eCascadia, Volvo VNR Electric, and Tesla Semi are in early deployments. LCVs are also booming: Ford E-Transit, GM BrightDrop, Mercedes eSprinter, and Rivian EDVs (for Amazon).

Fuel Cell Electric Vehicles (FCEVs): Hyundai’s Xcient fuel cell trucks, Toyota–Kenworth trials, and Nikola deliveries are live. Daimler and Volvo’s cellcentric JV aims to scale hydrogen long-haul by the late 2020s. India’s Tata and Ashok Leyland are piloting H2 buses and hydrogen ICEs.

E-buses: BYD dominates with 600,000+ units deployed, exporting to Europe and Latin America. Western players like Volvo, Daimler, and Proterra are ramping up as transit agencies shift fleets.

🌱 U.S.-based electric truck startups like Xos Trucks, ZM Trucks, Harbinger Motors, and Workhorse are pushing innovation at the bleeding edge—offering purpose-built electric platforms for last-mile delivery, vocational trucks, and municipal fleets. Their rise reflects a broader shift toward modular, software-centric commercial vehicles tailored to the needs of digital-first fleet operators.

Connectivity and Smart Fleet Management

Modern commercial vehicles are increasingly digital, connected machines on wheels. Fleet operators today demand not just strong engines and payload capacity, but also the data and intelligence to maximize uptime, safety, and efficiency. This has given rise to an ecosystem of telematics, onboard sensors, and software services that OEMs are rapidly expanding.

📡 Telematics & Fleet Management

Virtually all new trucks come equipped with telematics units that stream data on vehicle health, location, driver behavior, and fuel usage. The global CV telematics market was ~$24.3B in 2024, growing ~13% annually. Platforms like Volvo Dynafleet, Daimler’s Fleetboard, and PACCAR Solutions enable real-time diagnostics, route optimization, and predictive maintenance.

🛡️ Advanced Driver Assistance Systems (ADAS)

Features like lane departure warnings, blind spot monitoring, adaptive cruise, and emergency braking are becoming standard—legally required in Europe and increasingly adopted in the U.S.

🛰️ Over-the-Air (OTA) Updates & Software-Defined Vehicles (SDVs)

Truck makers now offer OTA capabilities for engine parameters and diagnostics. Long-term, this supports feature unlocks, dynamic software subscriptions, and data monetization—projected to be a $33B opportunity for OEMs by 2025.

🔐 Cybersecurity

As trucks become rolling IoT devices, attacks are increasing. 2024 saw a 35% rise in CV-targeted cyberattacks.

🌐 V2X & Infrastructure Integration

Trucks are starting to "talk" to infrastructure—communicating with signals, toll booths, and nearby vehicles.

🛠️ U.S. innovators like Bollinger Motors and The Shyft Group are leading the charge in combining rugged truck utility with advanced digital capabilities. Whether it’s integrating OTA-ready chassis platforms or connected fleet dashboards, they exemplify how startup agility is shaping the future of fleet management.

Market Outlook by Region and Competitors

Despite macroeconomic pressures in 2024 (e.g. high interest rates), the global CV outlook remains strong. Annual growth is projected at 5–6%, fueled by e-commerce, fleet replacements, and infrastructure spending.

📦 Key Trends by Region:

🇺🇸 North America: Still the world’s largest CV market. Strong pickup and Class 8 demand, aging fleet renewals, and new emission standards drive momentum.

🇪🇺 Europe: Highly profitable and rapidly electrifying. OEMs face strict CO₂ rules and growing demand for electric urban delivery and transit vehicles.

🌏 Asia-Pacific: The growth engine. India hit record M&HCV sales in 2023–24; Southeast Asia is investing $430B+ in infrastructure. China’s domestic market is plateauing but stabilizing with export-focused growth.

🛒 Last-mile delivery saw 22% YoY growth in 2024, driven by e-commerce—expected to hit $7T globally. EVs and smart LCVs will continue to surge.

Competitive Landscape: Titans vs. Challengers

🏢 Traditional OEMs — Names like Daimler, Volvo, PACCAR, Traton, and Iveco have decades of dominance. Their advantages: global support networks, brand trust, and deep manufacturing expertise. Daimler Truck, for example, posted $55.8B in revenue in 2022. But they’re also burdened with ICE-heavy portfolios, complex labor structures, and slower software capabilities.

These OEMs are evolving fast: modular platforms (e.g. Daimler’s shared architecture across brands), joint ventures (cellcentric, Volvo–Isuzu), and new business models like truck-as-a-service and subscription software are helping them pivot. They’re hiring software engineers, launching Silicon Valley R&D centers, and rebranding as mobility tech players.

🚀 Emerging Players — BYD, Tesla, Nikola, Farizon (Geely), and Euler Motors are fast, electric-native challengers. BYD has grown into a global CV player, exporting trucks and buses with integrated battery platforms. Tesla’s Semi has pushed the industry toward new energy benchmarks. Chinese OEMs (SAIC, Dongfeng, XCMG) and Indian startups (Olectra, Euler) are scaling in regional niches.

Challenges remain—scaling production, building service networks, and overcoming conservative fleet bias. Yet these players excel in focused innovation, often beating incumbents on price and tech in last-mile or urban fleet segments.

🧪 Hybrid Innovators — Players like Ashok Leyland and Tata are blurring the lines: combining traditional scale with aggressive EV and hydrogen experimentation. Ashok is piloting hydrogen ICE trucks; Tata aims for 30% electric CVs by 2030.

The moat of traditional OEMs remains—but it’s eroding. Top five truck OEMs now hold ~60% of M&HCV share—down from earlier decades.

Strategic Guidance for Commercial Vehicle OEMs

In this dynamic environment, commercial vehicle OEMs (and their executive teams) should consider several strategic priorities to thrive:

📍 1. Localize & De-risk

Near-shore production to avoid tariffs and delays

Tailor specs for local markets (e.g. RHD, toll class weight)

Build dual-sourcing strategies for semiconductors and batteries

🔁 2. Platform Modularity

Use flexible architectures supporting ICE, BEV, FCEV

Common ECUs/software stacks enable faster OTA and rollout

Swappable battery/fuel-cell modules help scale across segments

🤝 3. Build Strategic Ecosystems

Tech: Daimler–Waymo, Volvo–NVIDIA

Infrastructure: Joint charging or hydrogen stations

Service: Cross-brand service agreements or JVs

💰 4. Monetize Software

Subscriptions: diagnostics, ADAS, feature unlocks

Uptime services, TCO tools, and integrated fleet apps

Data resale (with consent) for smart cities/logistics

🌿 5. Lead in Sustainability & Safety

Offer EV consulting, charging infra support

Make ADAS standard, recycle batteries, use green materials

👷 6. Attract and Upskill Talent

Hire software, battery, and cybersecurity experts

Partner with universities and retrain internal staff

Promote mission-driven impact to attract Gen Z talent

Conclusion: Driving Forward

The global commercial vehicle market is entering a transformative era—where electrification, connectivity, and competition converge. Legacy strengths like reliability and scale still matter, but the race is shifting to software speed, zero-emission compliance, and ecosystem execution.

From electric trucks silently hauling goods to fleets controlled by AI-driven dashboards, the rules are being rewritten. The winners will be those who move faster, collaborate smarter, and invest boldly.

For CV leaders across North America, Europe, Asia, and Latin America, the question is no longer if change is coming—but whether their organization can move at the speed this new era demands.

Until next time,

- SDV Insider Staff

Today’s Article is Brought to you by Sibros

Sibros delivers a complete connected vehicle platform purpose-built for software-defined on and off-road vehicles. From real time data logging and over-the-air software updates to remote commands and diagnostics, Sibros helps OEMs unlock new value at every stage of the vehicle lifecycle. Get in touch with Sibros to learn more.