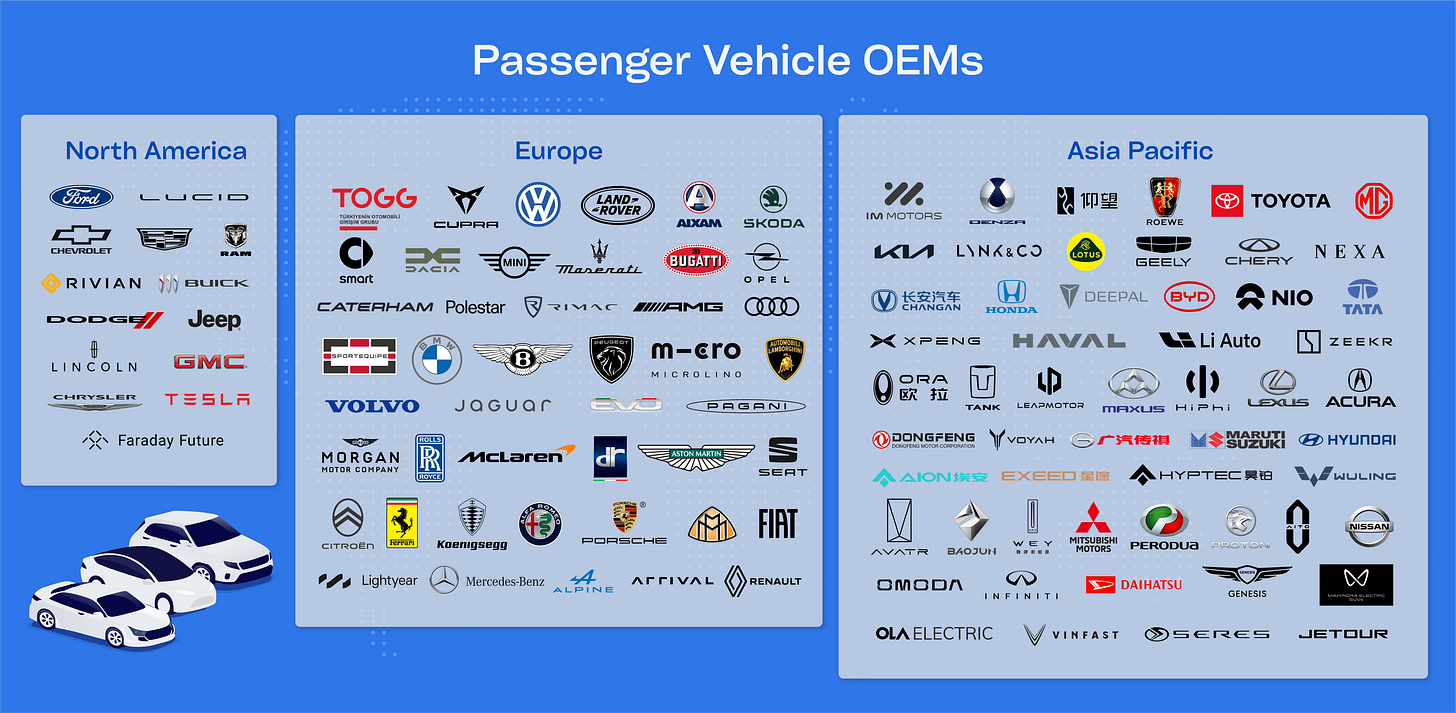

2025 Passenger Vehicle Power Map: Who Leads, Who’s Losing, What’s Next

Mapping the shifting power dynamics in a software and EV driven auto market.

🧭 Executive Summary

The global passenger vehicle market is undergoing a historic transformation, driven by electrification, software-defined platforms, and AI. Incumbent automakers retain volume dominance, but tech-native newcomers like Tesla and BYD are redefining what leadership looks like. This article distills the current state of play, regional market trends, technology disruptors, and strategic imperatives for OEMs navigating the road ahead.

Incumbents like Toyota, VW, and GM dominate by volume but face rising pressure from Tesla, BYD, and software-native players.

EV adoption hit over 20% globally in 2024, with China leading the charge.

Software-defined vehicle (SDV) architectures, OTA updates, and AI are fast becoming non-negotiable capabilities.

OEMs are shifting from hardware-first to tech-first operating models to stay competitive.

Strategic moves: double down on electrification, build software DNA, invest in data and AI, and form ecosystem partnerships.

🌍 Auto Thrones: Who Rules Where in 2025

Automakers are contending with a reshuffling of leadership across global markets. While Toyota, VW, and Hyundai-Kia retain scale advantages, Tesla and BYD are setting new benchmarks in innovation and EV performance. The realignment isn’t just about volume anymore — it’s about influence.

Toyota leads global sales (~12.5%), followed by VW Group (~9.8%).

Hyundai-Kia, Renault-Nissan, Stellantis, and GM round out the top volume players.

Tesla and BYD hold only ~2–3% global share but punch above their weight in the EV segment.

📍 Regional Highlights

Market leadership differs sharply by geography, shaped by policy, infrastructure, and consumer preferences:

North America: GM (~16%) and Toyota (~15%) lead. Tesla holds ~50% of the EV market.

Europe: VW dominates (~26% market share); EV share ~20%+.

China: BYD is the #1 brand; EV penetration is nearly 50%.

India & Japan: Still ICE-heavy, but EV adoption is rising. Tata, MG and Mahindra are leading the way for India’s EV market adoption.

Latin America: Early-stage EV adoption (~2–3%), but BYD is surging.

⚡ EV Adoption: Uneven, But Inevitable

Electrification is no longer on the horizon — it’s here. But while the global shift is underway, adoption rates vary significantly by region. Infrastructure, policy, and market maturity play pivotal roles in the pace of change.

📊 Global Trends

17+ million EVs sold in 2024 (>20% of all new cars).

EVs expected to surpass 25% of sales in 2025, possibly 40%+ by 2030 (IEA).

🇨🇳 China

EV share: ~50% of new cars.

BYD dominates: 26% of BEV, 48% of PHEV market.

China exported 1.2M EVs in 2023 — becoming a global EV hub.

🇪🇺 Europe

EV share: 20–25%.

Market cooled slightly in 2024 due to subsidy cuts (e.g., Germany).

Scandinavian countries lead (Norway >80%).

🇺🇸 North America

U.S. EV share: 12%+ in 2025 (1.6M+ sold in 2024).

IRA incentives boost demand; Tesla still dominates.

Pickup and SUV EVs gaining traction.

🌏 Asia-Pacific (excluding China)

Growth is mixed but gaining momentum.

India EV share rose to ~2% in 2024, led by Tata and MG with Mahindra catching pace fast; government incentives and charging buildout are expanding.

Japan remains hybrid-dominant; Toyota and Nissan are slowly expanding BEV offerings.

Southeast Asia is a hotspot for Chinese EV expansion, with BYD, Great Wall, and others ramping up local sales and assembly.

🌎 Latin America

EV share: 2–3%, but triple-digit growth.

Brazil and Mexico are key markets.

BYD has ~70% of the regional EV segment.

EV share: 2–3%, but triple-digit growth.

Brazil and Mexico are key markets.

BYD has ~70% of the regional EV segment.

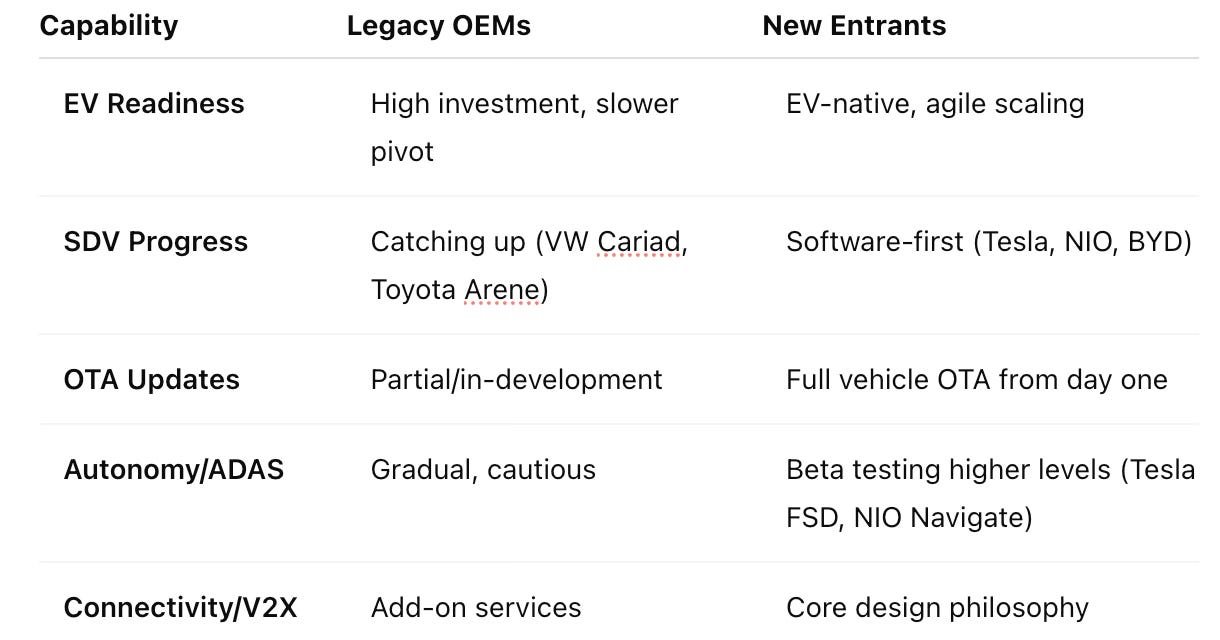

🆚 Traditional vs. Emerging OEMs: Digital Battleground

The battleground between legacy automakers and EV-native disruptors is increasingly defined by digital capability. Electrification is just one dimension — software, OTA readiness, and connected services now shape competitive advantage.

📌 Key Insight: Emerging OEMs lead in digital capabilities; legacy players must close software and OTA gaps fast.

🔮 5 Trends Reshaping the Market: Software Dominates

Beyond powertrains, a new generation of technologies is redefining how value is created and captured in the automotive world. These five trends are shaping product roadmaps and business models alike:

1. Software-Defined Vehicles (SDV)

Cars are becoming platforms. Centralized computing, OTA updates, and software-first architectures are redefining the vehicle lifecycle.

2. AI + Big Data

From predictive maintenance to automated driving, AI is becoming the engine of innovation — and competitive advantage.

3. Autonomous Driving (L2+ to L3)

The journey to autonomy is incremental. L2+ systems are widespread, while early L3 deployments offer a glimpse of hands-free driving.

4. V2X + Connectivity

Vehicles are joining the grid — communicating with each other, infrastructure, and energy systems. V2G, V2L, and C-V2X are just the start.

5. Electrification 2.0

Next-gen batteries, bidirectional charging, and energy-as-a-service models are expanding what it means to electrify.

📈 Strategic Recommendations for OEM Leaders

To win in the 2025+ landscape, automakers must move with urgency — and precision. The following actions are essential:

🚗 Accelerate EV Rollouts: Aim for >50% EV sales by 2030; back with supply chain, battery, and capacity investments.

💻 Go All-In on Software: Build internal software orgs, implement OTA, partner with tech/cloud players.

🧠 Use AI Across the Enterprise: From product to manufacturing to marketing — let data guide decisions.

🤝 Form Strategic Partnerships: Don’t go solo — ecosystems win (charging, infotainment, autonomy, supply chain).

🎯 Innovate Around the Customer: Monetize via services, personalize the UX, and engage users post-sale.

🌐 Be Regionally Agile: EV readiness and policy vary — decentralize execution while maintaining global architecture.

🚨 Bottom Line

The industry is shifting from a hardware game to a technology and ecosystem battle. To stay relevant, OEMs must adapt fast — blending the scale of incumbents with the agility of startups.

📌 Tomorrow’s winners will be those who ship software, data, and electrification at scale – not just sheet metal.

Until next time,

- SDV Insider Staff

Today’s Article is Brought to you by Sibros

Sibros delivers a complete connected vehicle platform purpose-built for software-defined on and off-road vehicles. From real time data logging and over-the-air software updates to remote commands and diagnostics, Sibros helps OEMs unlock new value at every stage of the vehicle lifecycle. Get in touch with Sibros to learn more.